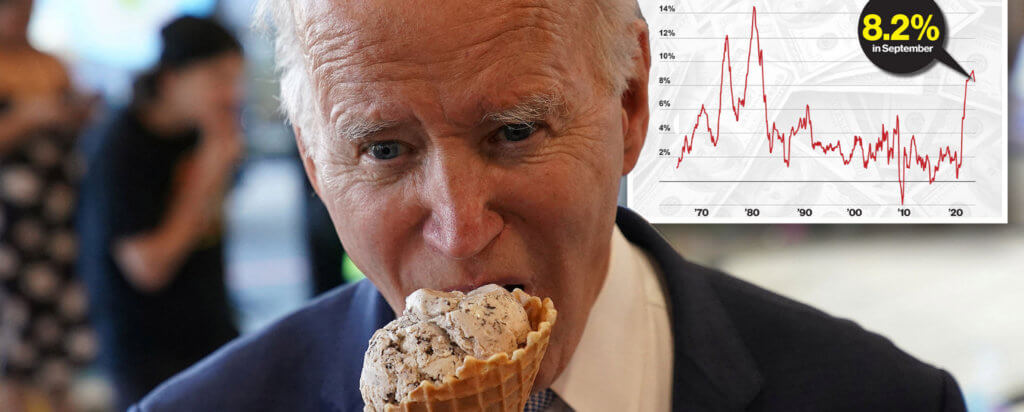

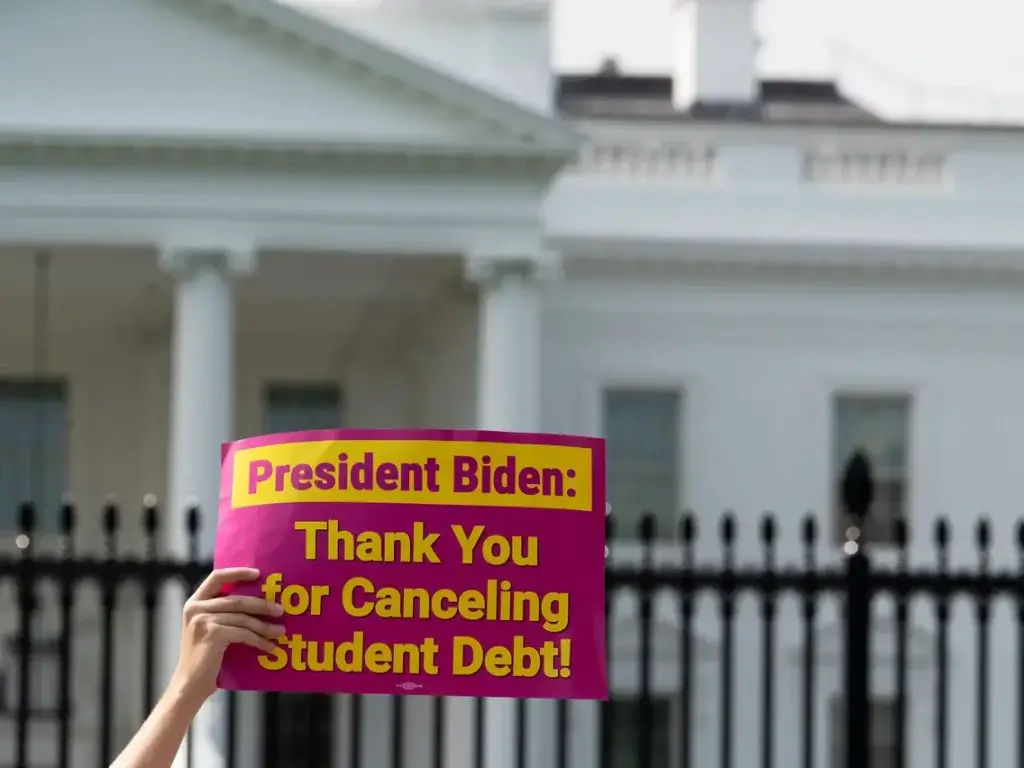

Maintaining the Student Loan Forgiveness Application Will Cost an Estimated $100 Million

This latest expense is yet more evidence that sweeping student loan forgiveness will end up doing considerable economic harm.

While the incredible costs of the Biden administration’s federal student loan forgiveness plan are widely known, yet another expense of the program is stirring controversy: maintaining the online application for loan forgiveness is expected to cost nearly $100 million annually.

This latest expense—not included in the Congressional Budget Office’s recent estimate of the program’s cost to taxpayers—is yet more evidence that sweeping student loan forgiveness will end up doing considerable economic harm.

(…)

The program stands to be wildly expensive, with recent estimates from the Congressional Budget Office predicting that its cost will be $400 billion. However, as the Biden administration gears up to formally release the online application for loan forgiveness, other large costs are also becoming clear. Documents submitted by the Education Department to the Office of Management and Budget show that the department estimates it will cost $99,900,000 per year to maintain the application and the program’s associated communications through March 2024. According to the Department of Education, these costs are “related to development of website forms, servicer processing, borrower support, paper form processing and communications related to this effort.” – READ MORE

Id like to offer a different perspective on this one, ill probably get some flack for it.

the real story here is that interest rates are alot higher now, so the necessary consolidation will result in many borrowers paying out that 20k they got in extra interest in a matter of a few years. it’s also going to pump fast money into colleges and the federally contracted loan servicers holding pre-consolidated debt. im not sure why this topic is being viewed as a threat to capitalism; these arent fair market loans; the loan servicers and federally contracted, given immunity from lawsuits (with only a few predefined exceptions), and the loans have special laws preventing their expiration. normally, a lender would let you pay off a debt at a fraction of the cost when they realize youve told them to fuck off and that discount would far exceed what this is. youde think the republicans would have winning this round easy with an economy like this, and they they keep taking the bait by whining on and on about it right before an election; i posit this is another distraction that will stuff debates full of topics in order to minimize representation of the economy.

on another point, i see alot of right wing sites just jumping on the side they think theyre supposed to be on, without really being informed. again, stupid move; these debts are egregious and they affect alot of voters. there is something fundamentally wrong with a bailout, and more sensible ways to deal with the problem, but just going against it right before an election after rubber stamping every bailout known to man in the last few years is a bad move politically.

an example of some misleading news on this is the story about a drastic turn in policy for the debt forgiveness with the sudden announcement of the requirement for consolidation to have occured before the end of september. the reality is that it takes 90 days to consolidate, and it had been announced that you cant apply for relief past december 31st. thus, anyone who gave a fuck wouldve been on that by the end of september.

mind you, a college loan debt stays the same, even if the value of the dollar plummets. it looks like pumping consolidated funds to schools and lenders holding debt will get them money now while it is more valuable than in the fast-approaching days of greater inflation. i feel like the forgiveness will be profitable for the loans where disparaged people had stopped paying decades ago; it doesnt quite make sense to give it to people who had 8k left to pay off. while i belief this bailout was actually for the larger corporate entities involved (with the borrowers incidentally getting a break) the media has focused away from them with the spotlight solely shinning on the chumps who took the loans out and watched as their interest accrued exceeded their payments every month decade after decade.