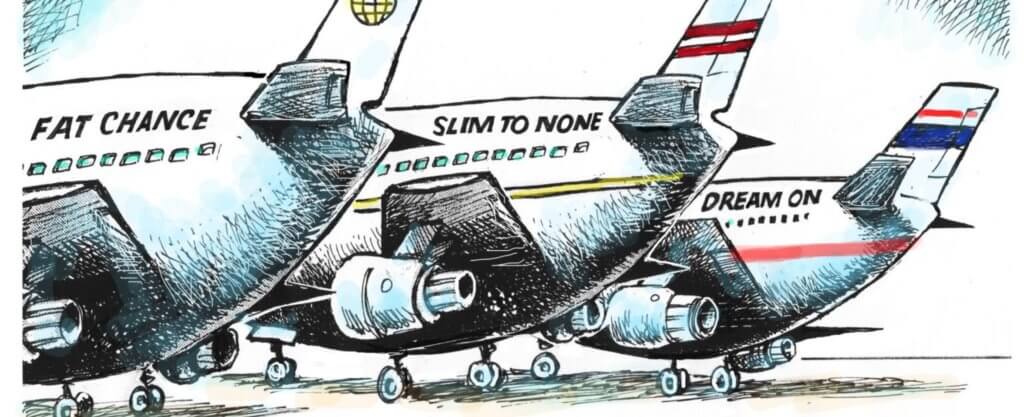

Big banks raising a giant red flag for U.S. economy

Some of the country’s largest banks are expected to see a 15% decline in profits in the fourth quarter compared to the year before, signaling a possible recession, according to the Wall Street Journal’s analysis of data from FactSet, an independent financial data company.

JPMorgan Chase & Co., Bank of America Corp., Citigroup Inc., Wells Fargo & Co., Goldman Sachs Group Inc. and Morgan Stanley will report their fourth quarter results in the coming days, which are expected to demonstrate a total of about $28 billion in profits, 15% lower than the fourth quarter a year prior, according to the WSJ. Banks have set money aside over the past year in anticipation of a slowing economy, which can cut banks’ profits.

Bank profits can serve as a bellwether for the broader economy; the factors contributing to declining bank profits, such as high interest rates, can also contribute to a possible recession by slowing housing and labor markets.- READ MORE

Responses