“A Recession Is Necessary” To Lower Demand As ‘Real Economy’ Routed By Soaring Fuel Prices

Sorry, But for You, Oil Trades at $250 a Barrel.

The culprit is the refinery margin and the consequences are huge for global inflation…

If you are the owner of an oil refinery, then crude is trading happily just a little above $110 a barrel – expensive, but not extortionate. If you aren’t an oil baron, I have bad news: it’s as if oil is trading somewhere between $150 and $275 a barrel.

The oil market is projecting a false sense of stability when it comes to energy inflation. Instead, the real economy is suffering a much stronger price shock than it appears, because fuel prices are rising much faster than crude, and that matters for monetary policy.

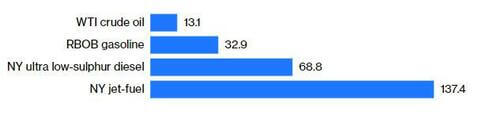

Petroleum Shock

Refined oil products have risen between 30% and nearly 140% since Russia invaded Ukraine in late February, compared to less than 15% for crude.

To understand why, let’s examine the guts of the oil market: the refining industry.

Wall Street closely monitors the price of crude, particularly a grade called West Texas Intermediate traded in New York. It’s a benchmark followed by everyone, from bond investors to central bankers. But only oil refiners buy crude — and therefore, are exposed to its price. The rest of us — the real economy — purchase refined petroleum products like gasoline, diesel and jet-fuel that we can use to run cars, trucks and airplanes. It’s those post-refinery prices that matter to us.

Responses